Introduction

Welcome to 2026 — a year where the rules of credit are shifting under our feet. If you’ve been keeping an eye on the financial news, you’ve probably heard rumblings about major changes in how credit scores are calculated. New scoring formulas. Alternative data. The sudden rise of “Buy Now, Pay Later” (BNPL) services. And in a shaky economy, layoffs and rising debts are everywhere.

In short: your credit score — once a relatively stable metric based on a few simple criteria — is now more fragile than ever. That’s why Credit Score 2026: 21 Shocking Ways New Scoring Models, BNPL & Layoffs Could Trigger Dangerous Credit Drops isn’t just another “what’s new in credit” article. It’s a wake-up call.

If you ignore what’s coming, you could wake up one day to a credit score collapse — and possibly denied loans, higher interest rates, or lost financial opportunities. But if you pay attention now, you still have time to protect yourself.

In this comprehensive guide, we’ll walk you through 21 of the biggest risks ahead — and more importantly, what you can do to stay safe and even benefit.

What’s Changing: The Rise of New Credit Scoring Models & Alternative Data

Before diving into the 21 risks, it’s vital to understand why things are shifting so dramatically.

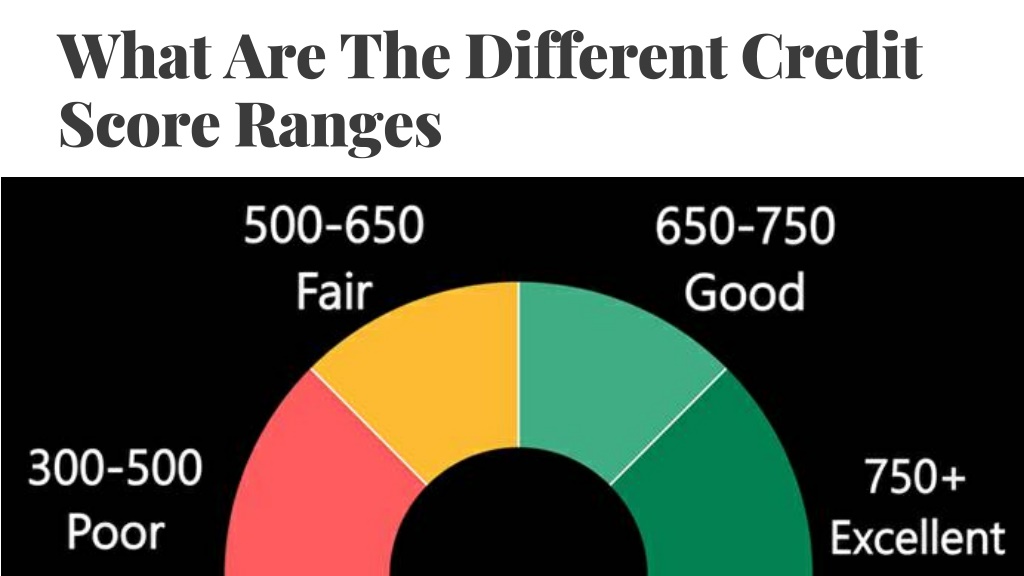

Traditionally, credit scoring models like FICO or VantageScore have relied on a fairly narrow set of data: credit cards, loans, payment history, credit utilization, and the like. But in 2025–2026, the landscape began evolving.

- Lenders and scoring agencies are increasingly incorporating alternative data — things like rent payments, utility bills, streaming-service subscriptions, telecom payments, even bank account cash flow. This aims to make credit more inclusive, especially for “credit invisibles.”

- At the same time, the explosion of BNPL loans — often used for everyday purchases — has forced scoring agencies to rethink what “credit” really means. Recently, FICO unveiled new credit score models that: for the first time, include BNPL data as part of your credit profile.

These shifts are well-intentioned: to reflect modern consumer behavior more accurately. But they also open up new risk vectors — ones many people don’t fully understand yet.

What This Means for You: 21 Ways Your Credit Could Take a Hit in 2026

Here are 21 shocking ways these changes — combined with economic stressors like jobs loss or rising debt — could result in dangerous credit drops.

| # | Risk / Trigger | Why It’s a Problem / What Could Happen |

|---|---|---|

| 1 | Multiple BNPL accounts opened in a short time | New scoring models may treat multiple new debt “lines” as risk, similar to credit-card openings — which can lower score. (CNN) |

| 2 | Missing or late BNPL payments | Since BNPL is now reportable, late payments will damage your payment history — the single most important factor in most scores. |

| 3 | High total BNPL balances / “stacking” BNPL loans | Big cumulative BNPL debt may look like over-leveraging, which lowers creditworthiness. |

| 4 | Frequent opening and closing of BNPL or short-term credit lines | Volatile credit behavior can signal instability to scoring algorithms. |

| 5 | Traditional debt (credit cards, loans) + new BNPL debt combined | More debt across multiple categories increases risk of credit drop, especially if utilization or repayment suffers. |

| 6 | Layoffs or loss of income resulting in delayed payments | Unemployment or reduced income may lead to missed payments — damaging both traditional and alternative-data-based scores. |

| 7 | Over-reliance on BNPL for everyday expenses | Using BNPL for recurring expenses — groceries, utilities — can lead to unsustainable debt and credit problems. |

| 8 | Ignoring alternative data obligations (utilities, rent, telecom) while expecting credit boost | Alternative data inclusion may help some, but neglecting those obligations offers no benefit — and could even hurt perceived stability. |

| 9 | Thin credit history (few traditional loans/cards) but heavy BNPL use | Scoring models may over-penalize users without established history — unpredictable outcomes. |

| 10 | Co-signing or joint BNPL/loan agreements without full control over repayments | Repayment missteps by a co-signer affect your score too — with less control. |

| 11 | High credit utilization on cards simultaneously with new BNPL cycles | Combining high utilization and BNPL debt creates “double risk”: both utilization and debt load. |

| 12 | Ignoring changing scoring model updates — not checking which model a lender uses | Score fluctuations may feel random if you don’t know whether lender used old or new model. |

| 13 | Applying for many new credit lines (cards/loans) during uncertain income period (layoffs) | New inquiries + unstable income = red flag for lenders under new scoring logic. |

| 14 | Unexpected “phantom debt” becoming visible — old BNPL obligations or non-traditional debts now counted | Debts you thought were under the radar may now suddenly harm you. |

| 15 | Overuse of credit for non-essential purchases (luxury, impulse) under debt pressure | When debt is high and repayment unreliable — major hit to creditworthiness under new scoring. |

| 16 | Using BNPL + traditional cards simultaneously without strategy | Over-concentration of debt across different account types increases volatility risk. |

| 17 | Ignoring credit report reviews after new model rollout | Without regular checks, you may miss negative entries from BNPL or alternative-data reporting. |

| 18 | Relying solely on old credit behavior (on-time card payments) expecting safety | Old behavior may not count as much if new risk factors apply — score may still drop. |

| 19 | Living paycheck to paycheck and using BNPL to tide over cash flow | Cash-flow instability + debt may lead to missed payments — big risk. |

| 20 | Lack of emergency fund during economic downturn or job loss | Without buffer, debt repayment becomes risky — leading to possible defaults or missed payments. |

| 21 | Not proactively rebuilding credit under new scoring regime once you see damage | Ignoring credit recovery can make you stuck in low-score territory for a long time. |

Deep Dive: Key Themes & What You Must Know

New Credit Scoring Models & How Alternative Data Will Affect Credit Scores in 2026–2027

The crux of many of the risks above boils down to one major shift: the expansion of what counts as “credit-worthy behavior.” Thanks to new models — especially from FICO — credit scores will no longer depend solely on traditional credit cards or loan data. Alternative data such as rent, utilities, phone bills, and even some BNPL repayment histories will now influence your creditworthiness.

Benefits of this change:

- People with little or no traditional credit history — like young adults or renters — may finally build a credit profile.

- Consistent timely payments of everyday bills (rent, utilities, telecom) can now work in your favor.

- Increased financial inclusion: more Americans become credit-worthy in the eyes of lenders.

Dangers of ignoring this change:

- Missing or being late on rent, utilities, or bills may now hurt your credit.

- Overlooking small monthly obligations because “they don’t matter” — could lead to negative scoring.

- Not monitoring which data your lenders or reporting agencies are using — leads to surprise credit drops.

What must be done:

- Treat all bills (rent, utilities, phone, streaming) as part of your credit health. Pay on time, set up autopay if possible.

- Periodically review your credit report and check which data sources contribute to your credit score.

- Build a diversified credit profile — not only cards/loans but stable bill-payment history, to survive model changes.

BNPL Impact & Why Credit Scores Are Dropping Due to BNPL and Debt in 2026

One of the most dramatic changes this year is the decision by FICO to integrate BNPL loan data into its scoring models.

BNPL services — offered by companies like Affirm, Klarna, and others — let consumers split purchases into short-term interest-free installments. This was once invisible to credit bureaus. But no longer.

Why this matters (and why scores may drop):

- BNPL defaults: late or missed BNPL payments will now be reported like credit-card delinquencies.

- Loan stacking: opening many BNPL loans in short time raises red flags for lenders evaluating risk.

- Debt accumulation: for people using BNPL + other debts (cards/loans), overall debt burden may exceed safe thresholds.

- Credit volatility: rapid BNPL activity may create instability — something scoring models view as dangerous.

Potential benefits (if you use BNPL responsibly):

- For those with thin credit histories, on-time BNPL repayments can build a positive credit record.

- BNPL becomes a credit-building tool — especially for younger users or those new to credit.

- Alternative credit path for people unable to access traditional loans or cards.

Risks of ignoring BNPL effects:

- You might end up with a lower score you didn’t expect — because you treated BNPL like a harmless payment option.

- You may get denied credit or loans, or face higher interest rates, because of high BNPL-related debt load.

- You risk “phantom debt” — thinking you’re fine because you paid off, while your credit record shows otherwise.

What you should do:

- Use BNPL sparingly, only when you’re sure you can pay on time.

- Keep BNPL obligations manageable — avoid stacking many at once.

- Regularly monitor your credit reports — especially after BNPL use — to see what’s being reported.

- Treat BNPL like any other loan: budget payments, don’t rely on it for everyday expenses beyond what you can repay.

Debt and Credit Drops — Impact of Layoffs on Credit Score and Loan Approval 2026–2027

The economy in 2026 remains uncertain. For millions of Americans, this means job instability, layoffs, and unpredictable income. Under older scoring models, a stable payment history might still carry you through. But with the new scoring logic — which looks at trending data, debt-to-income ratios (implicitly), alternative data, and overall debt burden — a job loss can trigger a cascade of credit damage.

How layoffs and economic stress increase credit risk now:

- Missed payments on existing loans, BNPL plans, or bills due to lost income.

- Increase in debt-to-income ratio when old loans remain but income stops.

- Delay in building stable, positive data entries (like rent, bills) — harming alternative-data-based scores.

- Lenders seeing declining repayment capability — reducing loan approvals, increasing interest rates, or denying credit altogether.

Why scores may drop even if you’ve been responsible with debt:

- The new models weigh stability and long-term behavior more heavily — sudden income shocks appear as instability.

- Having multiple debt lines (cards, loans, BNPL) during uncertain times magnifies risk.

- Even previously “safe” debt may turn risky if repayment becomes uncertain.

What you must do now:

- Build and maintain an emergency fund — it’s more critical than ever given volatile scoring.

- Avoid opening new credit lines (cards, BNPL, loans) if your job or income is unstable.

- If you’re laid off: proactively contact lenders to negotiate payment plans or deferments — better than missing payments entirely.

- Monitor credit reports carefully to see how new scoring factors are applied and correct mistakes if they appear.

21 Risk Triggers to Watch (Summary — Checklist for You)

- Opening many BNPL accounts at once

- Missing BNPL payments

- High cumulative BNPL debt (“loan stacking”)

- Frequent short-term loan/credit-line churn

- Combining BNPL + traditional debts irresponsibly

- Job loss leading to missed payments

- Using BNPL for everyday recurring expenses

- Ignoring rent, utility, telecom payments — especially if tied to alternative-data scoring

- Thin or no traditional credit history + heavy BNPL usage

- Co-signing debts or loans without full control

- High credit-card utilization while carrying BNPL debt

- Applying for new credit during unstable income periods

- Hidden/phantom debts from previously unreported loans now showing up

- Overuse of credit for non-essential or luxury spending

- Concurrent use of multiple credit types (cards, BNPL, loans)

- Not reviewing credit reports frequently

- Overconfidence in old credit behavior being “safe enough”

- Living paycheck to paycheck yet taking on new debt

- Lack of emergency savings

- Not proactively rebuilding credit after damage

Use this as your personal credit-risk checklist for 2026–2027.

Why This Matters for You — Benefits of Understanding & Acting vs Dangers of Ignoring

✅ Benefits of Following These Insights

- You stay ahead of the curve. As credit scoring evolves, those who adapt early will protect their credit worthiness.

- You avoid nasty surprises. No more waking up to sudden credit drops because of BNPL or alternative data you never considered.

- You build a resilient credit profile. Combining traditional credit, responsible bill-paying, and cautious BNPL use can position you well under the new system.

- You safeguard loan access. Especially important for mortgages, auto loans, business loans — lenders will appreciate a stable, transparent credit history.

⚠️ Dangers of Ignoring These Changes

- Sudden, unexplained credit drops. What used to be “safe” may now carry risk.

- Rejected loan applications or higher interest rates. Lenders may see you as unstable or over-leveraged.

- Hard to rebuild credit. Once alternative-data or BNPL-based negative entries are on your report, recovery may take longer.

- Financial stress and missed opportunities. Credit isn’t just a number — it affects housing, car loans, business financing, and more.

What You Should Do Right Now — Best Ways to Rebuild Your Credit Under New Scoring Models in 2026

If you read this far — good. Because this section is your action plan.

- Audit your current debts — list credit cards, loans, BNPL agreements, recurring bills (rent, utilities, telecom).

- Prioritize stable repayment — treat BNPL loans and recurring bills with the same seriousness as credit-card or loan payments.

- Avoid “loan-stacking.” Resist taking on multiple BNPL loans or credit lines at once, especially if budgeting is tight.

- Build an emergency fund. Try to set aside 3–6 months’ worth of living expenses. This provides a buffer if income stops.

- Use BNPL only when necessary — and only if you’re sure of repayment. Think of it as a loan — not free money.

- Diversify credit and payment history. Combine traditional credit (cards, small loans) with consistent bill-paying (rent, utilities), to build a broad, strong profile under new models.

- Monitor credit reports regularly. Check for new entries — especially from BNPL firms or alternative data — and dispute any errors immediately.

- If facing layoffs or income instability — contact lenders proactively. Many will offer hardship plans or deferments.

- Be cautious with new credit applications. Opening too many lines at once creates risk under new scoring algorithms.

- Educate yourself about what data is being used. Know whether your lender uses the new scoring models or old ones, and which data sources matter.

Real-World Example: How Two Consumers Could End 2026 — Very Differently

| Scenario | “Ben” — The Cautious Planner | “Jade” — The BNPL Addict / Income-Shaky |

|---|---|---|

| Starts 2026 | Moderate credit (cards), stable job, some rent/utilities | Thin traditional credit, frequent BNPL use, job in volatile industry |

| Behavior | Pays rent & utilities on time, uses card responsibly, avoids BNPL except emergencies, builds small savings buffer | Uses BNPL often for purchases, misses some bills, relies on occasional freelance gigs |

| Mid-2026 events | Economic slowdown — but emergency fund covers 3 months; all payments continue | Job loss + no buffer; misses BNPL payments and bills |

| Credit by end of 2026 | Credit score holds steady or improves — thanks to stable payment history, diversified data | Credit score drops sharply — BNPL defaults + missed bills + high debt utilization |

| Loan access | Qualifies easily for car loan or mortgage | Denied or offered high-interest loan; credit rebuilding will take years |

This hypothetical shows clearly how 2026’s changes magnify differences between cautious and careless financial behavior.

Conclusion — The Credit-Score Game Has Changed. It’s Time to Adapt.

2026 isn’t just another year. It may be the turning point for credit in the U.S. The credit scoring rules are shifting — and with them, the financial fate of millions.

If you treat your finances like you always did, relying solely on old habits (paying credit cards, taking occasional loans), you risk falling behind. But if you adapt — monitoring bills, being cautious with BNPL, diversifying your payment history, building savings — you can not only survive the transition but come out stronger.

The truth is simple: what got you a good credit score before may not be enough anymore.

So please — take this seriously. Audit your finances, plan ahead, and treat every payment as part of your credit story. Because now, more than ever, your financial reputation depends on it.

Let 2026 be the year you take control.

If you found this helpful, share it with someone who still thinks BNPL is “free money.” Better to know now than regret later.